Table of Contents

Guido Mieth/DigitalVision via Getty Images

Background

Amyris (AMRS) is one of the future leaders in the synthetic biology industry. The company has been innovating with their pipeline of products, furthering their mission of environmentally sustainable growth investing. Ever since the disastrous Q3 results Amyris has been very range bound within the 4-6 dollar range. In 2022, Amyris has a great opportunity to benefit from potential biotech tailwinds. I will also be looking at Amyris’ financial situation and earnings growth.

The Horrendous Q3 and Potential Bright Spots of the Report

After Amyris released their Q3 2021 earnings report, there was a very visceral reaction to the stock. On November 9th 2021, Amyris shares fell roughly 50% in one day. This was due to the company announcing top and bottom line disappointments. The company subsequently announced a 690 million dollar capital raise with a 1.5% interest rate. This was quite the fall from grace for a stock that had been doubling YoY. The price shock rattled investors and Amyris stock has been range bound since. However, I do believe there were beneficial pieces of information in the company’s Q3 2021 earnings report.

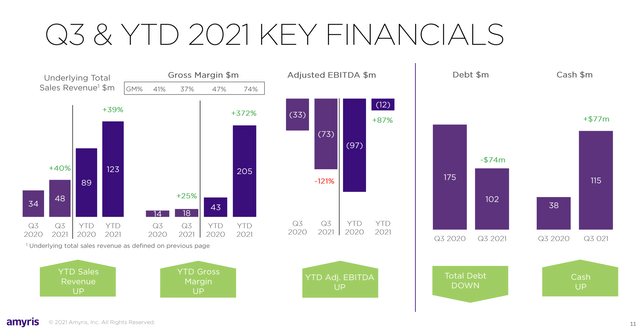

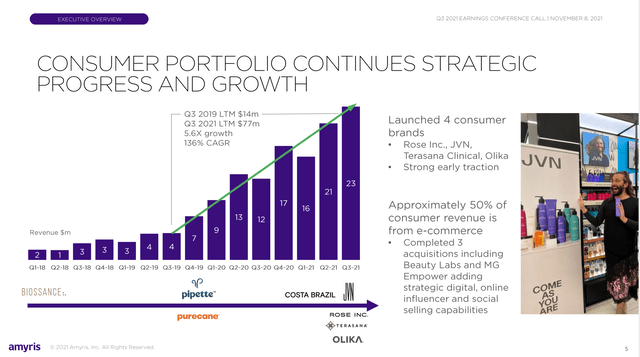

Source: (Amyris Q3 2021 Earnings Presentation)

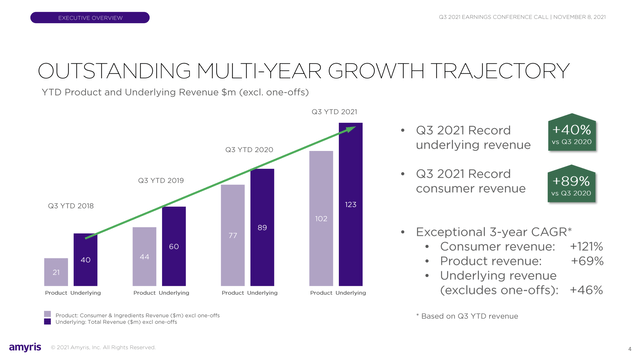

Source: (Amyris Q3 2021 Earnings Presentation)

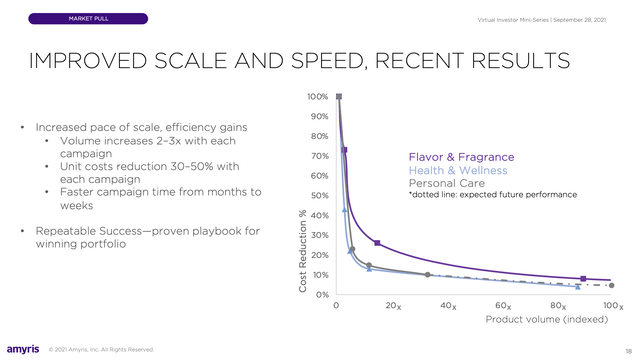

The bottom line is that Amyris did not report the worst numbers in the world. The company has been expanding operations finally has decent profit margins for many of their products. This will enable Amyris to grow into its multi-billion dollar valuation and beat investor expectations. Even though their profitability timeline was pushed back I still believe in Amyris’ ability generate revenue in the short to medium term.

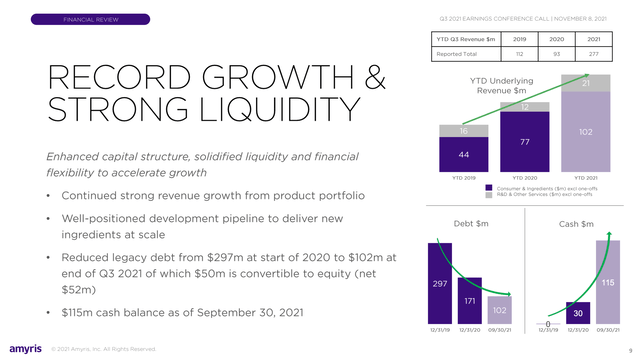

Source: (Amyris Q3 2021 Earnings Presentation)

Source: (Amyris Q3 2021 Earnings Presentation)

Amyris has a multiyear growth strategy that can’t be shaken by one poor quarter. The record revenue growth should not be taken lightly as Amyris’ products have outperformed commercially. Currently consumer revenue is up 89% YoY which may even expand moving forward with future products. I believe in Amyris’ ability to compound their technological advantage to fuel earnings and share price growth.

Source: (Amyris Q3 2021 Earnings Presentation)

Even after Amyris’ capital raise their liquidity plan is strong. The company has been actively cutting legacy debt and lowering their overall debt exposure. Management’s decision to raise capital at 1.5% is not a bad long term investment. At today’s interest rates it would be very smart for a growing biotech company to raise capital to pay down higher interest rate debt. Overall, I believe in the future financial strength of Amyris through their core product line and increasing gross margins.

Consumer Brands and Partnerships are Driving Growth

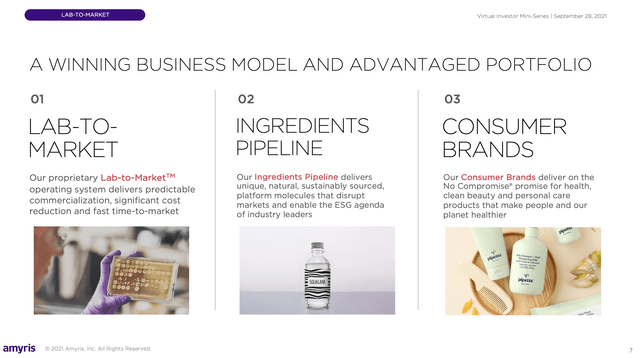

Partnerships and brand relations will be very important to Amyris’ success moving forward. Amyris’ produces chemical substitutes for compounds only found in animals. The beauty industry has been notorious over the past couple year for abusing animals to create their products. Amyris fixes this problem for many large beauty conglomerates. This will also help investor relations as exposure to Amyris will raise a company’s ESG score. Even though ESG may be a buzzword there is significant money flowing into the sector. Amyris has great potential to be the first mover in a growing industry.

Source: (Amyris Q3 2021 Earnings Presentation)

Source: (Amyris Q3 2021 Earnings Presentation)

The lab to market pipeline has shown immense value over the past 12 months. Amyris continues to expand their Pipette and Biossance brands internationally. Amyris’ commercial and industrial revenue streams have the potential to create positive earnings momentum for the stock. As consumers increasingly become environmentally conscious both brands could see exponential increases in valuation over the next couple of years.

Source: (Amyris Q3 2021 Earnings Presentation)

Source: (Amyris Q3 2021 Earnings Presentation)

Growing the portfolio will be key to Amyris’ continued success. Amyris has been quietly completing numerous acquisitions with sustainable beauty brands across the world. Most notably expanding into Latin America with Costa Brazil and furthering their commercial business with an AI beauty application company Beauty Labs. I like the variety of businesses Amyris is investing in and believe they will have great synergies moving forward.

Source: (Amyris Lab-to-market Health and Beauty Products)

Source: (Amyris Lab-to-market Health and Beauty Products)

Scale is going to be critical for Amyris moving forward. The company needs to leverage the synergies within their consumer brands and clinical portfolio to generate steady revenue. This will help fuel self-sufficient growth which would enable a multiple re-rating by big institutions. I am investing in Amyris for the long term because I believe in the strategic vision of the company and the overall growth of synthetic biology in the coming years.

Risks to the Long Term Emerging Market Thesis

There are still large risks to Amyris’ future share price. The company needs to stop the excessive cash burn and streamline operations. If the company can find the right mix with their recent acquisitions the company has considerable earnings value moving forward. The main risks I see to Amyris’ long term success is investor confidence and patience. Many big institutions will need to be confident over the next year for Amyris shares to have a terrific 2022. I generally don’t recommend companies that don’t have self-sufficient growth but Amyris is different. The value of their product portfolio is much higher than the current market capitalization of the company based on conservative TAM estimates. Many of these calculations around valuation. and TAM I made in my previous Amyris article.

Valuation is Low Given Price Compression Within the Industry

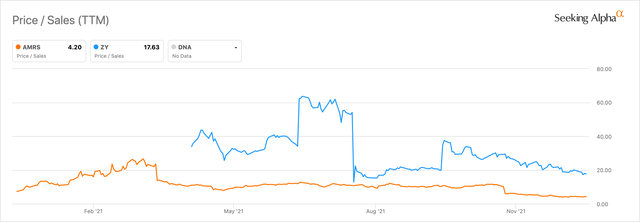

Amyris has a strong valuation relative to its peers. The two main competitors to Amyris in the synthetic biology space are Zymergen (ZY) and Gingko Bioworks (DNA). Zymergen is similar to Amyris in the sense that they are trying to expand their clinical and consumer portfolio. The company also recently had a massive dip in shares due to pushing back substantial revenue and profitability dates. Zymergen is slightly smaller than Amyris and I believe Amyris is much further along in their product pipeline than Zymergen. Gingko Bioworks on the other hand is a very interesting case. I believe that Gingko can challenge Amyris on the clinical side of the synthetic biology industry. Gingko Bioworks inks large contracts to manufacture compounds for large corporations and then sell the patent and licensing. I believe at scale this business model has incredible opportunity, however that has yet to be seen. Overall Amyris is a great way to play consumer and clinical synthetic biology.

Source: (Amyris Seeking Alpha Price/Sales Tool Peer Comparison)

Source: (Amyris Seeking Alpha Price/Sales Tool Peer Comparison)

Comparing Price/Sales is difficult because this an emerging industry without consistent revenue. However Amyris is the most fairly valued of Zymergen and Gingko Bioworks as they boast a 4.2 Price/Sales rating. I believe this is quite the conservative valuation given Amyris’ technology. This Price/Sales ratio reflects the recent price drop well as there is a clear dip in the price to sales ratio at the beginning of November. Moving forward if Amyris is able to cultivate positive earnings momentum this multiple may be quickly expanded.

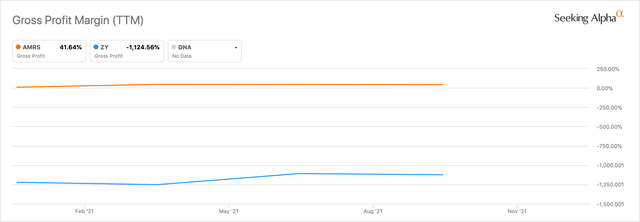

Source: (Amyris Seeking Alpha Gross Profit Margin tool Peer Comparison)

Amyris has much higher gross profit margins than its peers. This is because Amyris is much farther in their operations and product pipeline than both Zymergen and Gingko Bioworks. Amyris currently boasts over 40% gross margins which may expand due to the recent SaaS acquisition of Beauty Labs. Amyris is a great fundamental turnaround story that could be incredibly beneficial to early investors.

Conclusion and Thoughts

Amyris has had a very negative 2021 but I believe they will be able to turn things around in 2022. The strong product pipeline should only expand moving forward with future acquisitions. The valuation proposition offer investors a superior risk/reward ratio. Overall, I am doubling down on Amyris and retain my Very Bullish Rating.