[ad_1]

In accordance to Michigan Retailer Association’s study of retail sales offered in its 2021 Invest in Nearby Research, countrywide ecommerce product sales grew from 8.8 percent of full retail revenue in 2017 to 10.7 percent in 2019, and then jumped yet again to 13.6 per cent in 2020. Although this data is tough to delineate at a point out-degree, there is no doubt that Michigan’s retail sector has likely been through a identical transformation.

Amid the COVID-19 pandemic, incorporating ecommerce as a mode for promoting has been important for quite a few Michigan suppliers. Without it, additional stores would not have survived the pandemic.

As on the internet sales expand, so does fraud

As a lot as suppliers have benefited from ecommerce gross sales, on-line credit card fraud has jumped considerably throughout the U.S. According to LexisNexis, U.S. ecommerce retailers documented a 140 per cent improve in fraud assaults due to the fact 2020. Moreover, according to a latest short article in Business enterprise Insider, card-not-current (CNP) fraud is predicted to mature by 14 percent in the following 4 several years.

1 of the most frequent approaches cyber criminals get stolen credit rating card quantities is by the darkish net. Most stop by a internet site on the dim web and obtain stolen credit rating cards in bulk with the goal of screening them to come across the ones that function. In 2019, there ended up at the very least 23 million stolen credit rating card figures for sale on the dark internet. That range has only elevated considering the fact that then.

What does this fraud imply to your business enterprise? Think a lot more chargebacks, penalties, missing earnings, and a new status amid criminals that your company is an uncomplicated concentrate on.

I say this frequently: fraud avoidance is a journey, not a place. Cyber criminals are very complex and they change solutions commonly and frequently. There are, on the other hand, a few steps you can just take that will enable you avoid fraud in the course of a transaction. They can expose a likely credit score card theft in the building.

- Do you take discover if your terminal encounters an EMV chip malfunction?

Although most of this write-up is connected to ecommerce, one particular of the means that bad men use stolen card quantities is through a confront-to-encounter transaction that is not “dipped” into the chip reader.

Whilst most retailers use an EMV chip reader, terminals are set up to let for transactions to be processed working with a magnetic strip to accommodate more mature cards with no chips, or cards with malfunctioning chips. This is the loophole that criminals are now exploiting.

If a terrible male has a good card amount (and the connected information from the mag stripe), they can encode that on a legitimate card and then damage the card’s EMV chip. This will power your terminal to accept a swipe (with the stolen card variety on the magazine stripe, instead of the genuine card selection).

When they make a acquire, they insert the card in the chip reader, which will report an error since the chip cannot be read. Then, they will tell the clerk that they’re obtaining problems with the EMV chip on their card and request if they can complete the transaction by either swiping the magnetic strip or acquiring the clerk critical in the account quantity, bypassing the EMV chip reader all together.

Acquire observe, you need to be vigilant with your staff about always employing an EMV chip reader. The major card networks have clear policies about this. If a service provider enables a purchaser with an EMV chip credit card to make a invest in by swiping the card in lieu of making use of the chip reader, any chargebacks submitted versus the transaction will automatically be uncovered in the cardholder’s favor.

Warn your personnel to just take take note when this transpires, particularly if it is a significant-ticket variety this sort of as jewellery, appliances, or a pc. If your EMV chip reader proceeds to fall short, it could be time to up grade your program.

- Does your website require a 3-digit security code for all on-line transactions?

In accordance to a 2021 Nilson Report on credit history card fraud, the amount of money of funds lost to card-not-present fraud in 2020 was 6 instances larger than what retailers missing just one 12 months before. That’s why the have to have to make absolutely sure that any buys manufactured on your web site demand a security code.

A credit rating card stability code, commonly acknowledged as the card verification price 2(or CVV2) is the three or 4 -digit code generally observed on the again of a credit history card. The CVV2 offers an added layer of security by verifying that the purchaser is in possession of the card.

To stay PCI compliant, you are not permitted to shop CVV2 codes on your system. This assists in guarding clients from a knowledge breach and helps make it tricky for cyber criminals to get a customer’s CVV2. Not complying with worldwide PCI Data Protection Requirements could outcome in hefty fines or even even worse – the cancellation of your service provider processing obtain by the payment processor.

- Does your site contain a CAPTCHA as part of the checkout course of action?

Just one of the issues that lousy guys have is figuring out if the card numbers that they acquired on the dark internet are still lively and “good.”

A popular on the web technique employed by criminals is accessibility websites to exam a group of stolen cards by conducting minimal-sum transactions, normally $1 or $2 to find the playing cards that are nevertheless active. This style of account screening is recognized as “card tumbling.” One of the main outcomes of staying a target of a card tumbling assault like this is the considerable costs your account can arise if the scale of the assault is substantial. Some examples of costs include authorization, clearing and settlement, interchange, and gateway transactions.

Anything at all you can do to gradual down the system of receiving an authorization try on a transaction keeps card tumblers at bay. This is where by which includes a CAPTCHA as portion of your on-line checkout process plays a essential role. According to Dictionary.com, the origin of CAPTCHA stands for “completely automatic public Turing test to convey to personal computers and humans apart.” It is a variety of challenge-response examination made use of to decide whether or not the person is a human or a bot. To go the examination, people must interpret distorted textual content by typing in accurate letters into a sort field. In the scenario of a re-CAPTCHA, the person is needed to detect a set of objects in a picture.

Whilst CAPTCHAs get their reasonable share of critics, they’ve accomplished a tremendous career in guarding ecommerce websites from brute drive assaults.

As outlined at the beginning of this posting, this procedure of safeguarding you is a journey, not a place. It is a little something that you need to be spending awareness to regularly.

As normally, if you have questions about this situation or any other merchant processing difficulty, make sure you do not hesitate to make contact with our customer company workforce at 800.563.5981

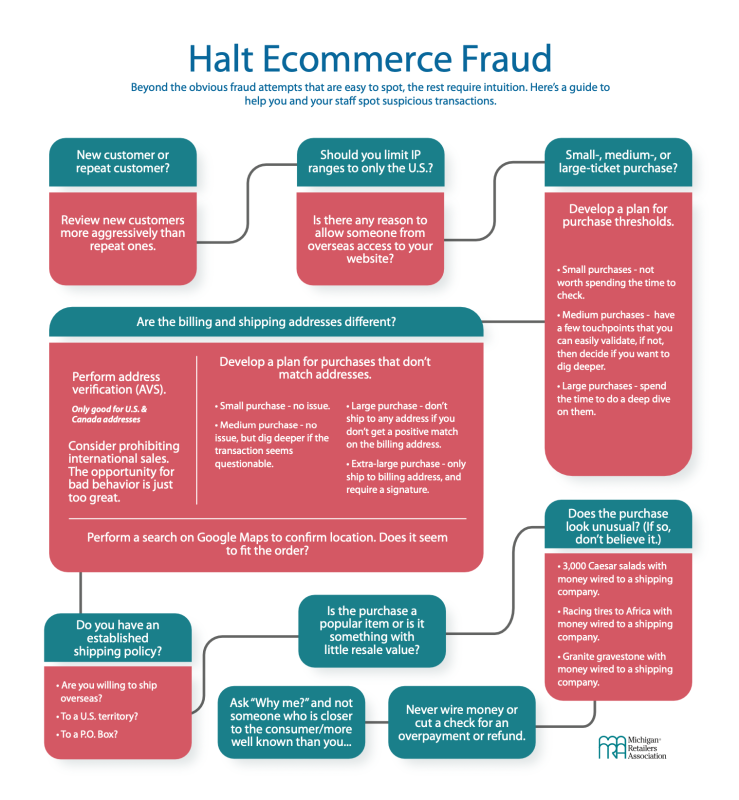

Use this Ecommerce Fraud Determination Tree graphic to enable you and your staff members location suspicious transactions.

[ad_2]

Resource backlink